Ukraine, Russia and The Alternative Investment Standards

The war in Ukraine has had, and will continue to have, consequences for global markets. Energy prices rising, sanctions limiting liquidity in Russian assets, the threat of default on Russian bonds and a rush to divest from Russian assets impacting prices and increasing the risk of stranded assets to name just a few. For alternative investment portfolios exposed to these assets there is potentially an undefined period where assets may become illiquid, and valuation becomes more difficult. We have already seen suspension of funds with either a Russia focus, or significant exposure, and the UK FCA has announced a consultation on the use of side pockets in retail funds with these exposures.

We believe it’s vital at these moments of market crisis that the alternative investment industry maintains high standards in risk management, valuation, and liquidity management. The SBAI Alternative Investment Standards are relevant to the current situation and can help ensure a robust control environment. The Alternative Investment Standards cover disclosure, valuation, risk management, fund governance and shareholder conduct. In addition to the areas of the Standards mentioned below strong fund governance is also critical to ensuring that events are handled in the proper way and in the interest of the investor, Standards 21 and 22 cover this in detail.

Investors should be discussing the response to this crisis with their asset managers. The second part of this memo discusses the questions that investors should ask of their asset managers.

Risk Management Standards

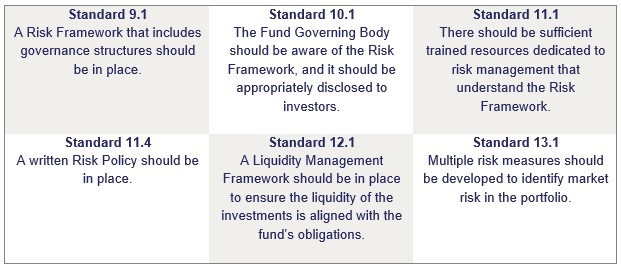

Volatility and extremely limited liquidity will impact both the portfolio and the liquidity risk of the fund. Alternative investment managers who already have strong risk frameworks will be better placed to assess and act on these risks where necessary.

Signatories to the SBAI Alternative Investment Standards will have these controls in place where they comply with standards such as:

Valuation Standards

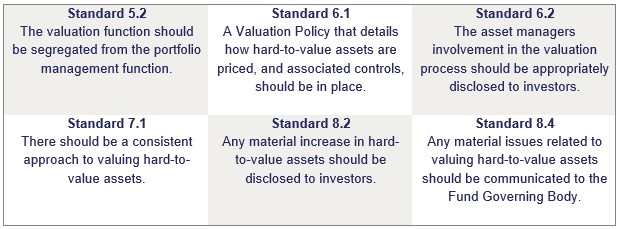

As assets become stranded due to limited buyers or sanctions preventing their sale, assets that were liquid can soon become illiquid and hard-to-value. Alternative asset managers need to have governance and control processes to manage valuation in these situations.

Signatories to the SBAI Alternative Investment Standards will have these controls in place where they comply with standards such as:

Investor Liquidity – Side Pockets

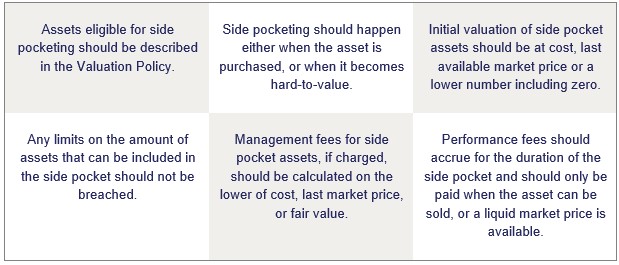

Asset managers with significant exposure to Russian assets may find themselves unable to trade or appropriately value these assets. This may impact the fair treatment of incoming, redeeming and remaining investors. Suspensions or gating of redemptions are tools that can be used, but asset managers may instead opt to use side pockets to segregate impacted assets and continue to provide liquidity related to unimpacted assets to investors. Side pockets are useful tools for this purpose - providing they are appropriately governed with the right controls in place.

Signatories to the SBAI Alternative Investment Standards will have these controls in place complying with Standard 7.2 which states:

Our Alternative Investment Standards were formed in collaboration with asset managers and allocators to further our mission of improving industry outcomes. Being a signatory to these standards means you will already have the tools and controls in place to appropriately manage situations as they arise and will be able to communicate these effectively to your investors. The SBAI Toolbox also contains additional guidance and tools that will aid asset managers in these situations including Open Protocol Risk Reporting for providing exposure data to investors and a Standardised Board Agenda that includes liquidity risk as a standing agenda item.

Questions for Allocators to Ask

Investors should discuss the controls mentioned above along with the governance structure and ask managers to explain how they have approached the current situation – particularly where there is material exposure.

Below is a list of questions that investors may want to ask asset managers:

Do you have exposure to Russia or other eastern European countries impacted by the Russia/Ukraine conflict? If so:

Exposure

- How much ($ amount and as a % of fund AUM)?

- What investment/security types?

International Sanctions

- Do any of your funds have exposure to sanctioned investors or investments?

- How are you identifying sanctioned investors or investments in your funds?

- What are you doing in the situation one of your funds has a sanctioned investor or investment?

- How are you approaching a scenario where a sanctioned investor (or one that is expected to be sanctioned) submits a redemption request?

- How and what are you communicating to your investors/other external stakeholders regarding exposure to sanctioned investors or investments?

Valuation/Other

- How are you valuing Russian/Ukrainian/other impacted holdings?

- Have you needed to change pricing methodologies/sources/inputs?

- Have you observed or do you anticipate any: a. Increased use in 3rd party valuation agents, b. NAV delays, c. Side-pocketing of investments?

- Have you observed any impact to the custody of assets?

- Have or do you expect any impact to operations, service providers or outsourcing relationships in the region?

The situation is fluid and not yet resolved. This means asset managers need to continue to follow control and governance procedures to ensure fair treatment of investors and investors need to continue to have these conversations with asset managers to keep on top of the situation.

The description of the Standards above is a summary of the full text of the standard. Please visit the Standards page of our website to view each standard in full including guidance on how to comply with each standard.