SBAI Standards and Guidance Addressing Systemic Risk Concerns

Financial regulators have raised concerns related to non-bank financial institutions and the potential for hedge funds to generate market volatility and financial instability following the recent crisis prompted by the collapse of Silicon Valley Bank (SVB) and a resulting rally in bonds as a result of a flight to safety [1].

The discussion about addressing presumable structural vulnerabilities from asset management activities is far from new. Since the Financial Crisis in 2007/2008 (which was also prompted by banks taking excessive risk), financial authorities have consulted on policy recommendations to address potential concerns and we at the SBAI have engaged extensively with the authorities on these topics [2].

The result has been wide ranging regulatory reforms of asset management and financial services regulation to address the key lessons learned during the Financial Crisis. The measures include, amongst other things, direct manager supervision, improved investor disclosure, central clearing of OTC derivatives, manager reporting to authorities to enable (systemic) risk assessments (e.g., Form PF, AIMD-Annex IV), and more stringent capital requirements for banks.

Overall, the asset management sector generally has been resilient and has not created financial stability concerns in periods of stress and heightened volatility and, furthermore, the sector offers some important stabilising features to the global financial system. This assessment should not come as a surprise, given both the ability of funds (and fund investors) to absorb losses and the great diversity of types of funds (and risk management approaches). In fact, the transfer of risk out of the banking system into the capital markets and investor portfolios is a positive development, enhancing the resilience of the overall financial system.

It is important to highlight that the presence of active investors in markets, such as hedge funds, which invest in research and may express differentiated views - e.g., through short selling, contribute to efficient price discovery, increased liquidity - to the benefit of all investors.

We support efforts to facilitate fair and efficient markets, reduce systemic risk, and help investors to make well-informed investment decisions. We work with institutional investors, alternative investment managers and financial regulators to improve industry outcomes and account for issues in relation to financial stability, investor protection and market integrity through the Alternative Investment Standards and Toolbox of practical guidance. This includes Standards and guidance that deal with the specific concerns raised about investors such as hedge funds posing risk to the financial system.

The Alternative Investment Standards

The Standards cover risk management practices (liquidity, market and counterparty risk; stress testing) for the managers and also cover a wide variety of risk disclosure to investors (including leverage and sources of leverage) to enable well informed investment decision making and ongoing monitoring. To specifically address concerns about transmission of risk from hedge funds into the banking system, the Standards require confidential reporting from asset managers to prime brokers and other counterparties to improve risk transparency and enable their ongoing counterparty risk monitoring and well-informed lending decisions to hedge fund clients. This requirement was introduced in the Standards in 2008 to prevent the build-up of excessive risk at banks.

SBAI Transparency Tools

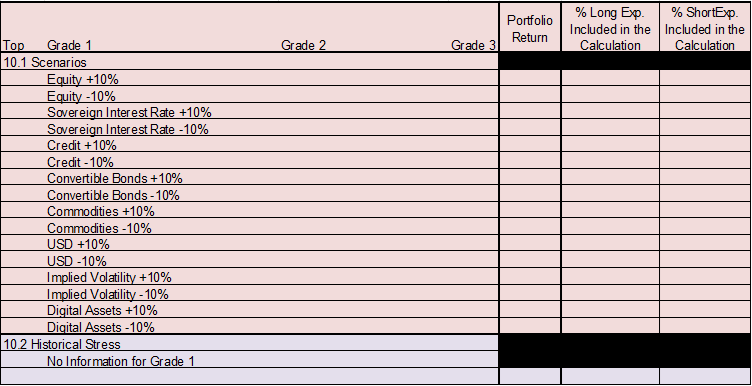

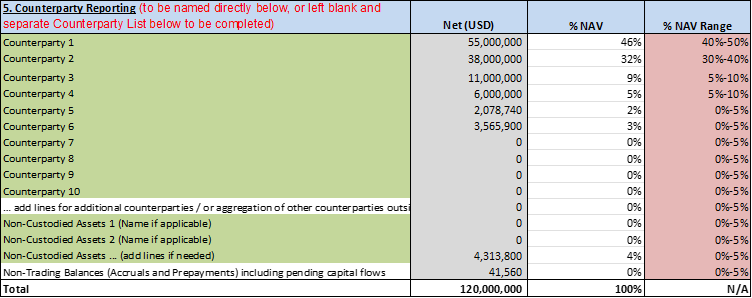

The Open Protocol (OP) templates standardise the reporting of fund risk data to investors, including gross exposures, stress tests, and counterparty risk. Improved risk disclosure from funds can benefit allocators and regulators in the collection and aggregation of data to assess systemic risk concerns.

Example: Stress testing results in Open Protocol

The SBAI also provides the Administrator Transparency Report (ATR) to provide independent transparency on fund assets and liabilities, pricing sources, and counterparty exposures in a standardised format.

SBAI’s lessons from market events

We at the SBAI review notable market events and help investment managers and institutional investors understand how these incidents relate to the Standards and Guidance we provide, to help improve risk management provide investors with the key questions to ask. Recent examples include the SVB failure, where we explore how the risk practices in the Alternative Investment Standards can help address deposit/counterparty risk, the Archegos family office failure, where we specifically asses the counterparty risk transmission channel, and the impact of sanctions on Russia in the context of the Russian invasion of Ukraine.

We encourage the alternatives community and authorities to review these SBAI resources.

_____________________

[1] Financial Times, 15 April 2023: US regulator calls for greater scrutiny of hedge funds after bond turmoil, https://www.ft.com/content/7a4fc077-0d70-4343-9b0c-4c2f588f3d7a

[2] SBAI Regulatory Engagement – Financial Stability: https://www.sbai.org/regulatory-engagement/financial-stability.html

Related Resources