Responsible Investment: Are You Saying What You're Doing and Doing What You're Saying?

In May 2022, the US SEC charged an investment adviser for misstatements and omissions concerning ESG considerations resulting in a $1.5m penalty. The SEC order found that the adviser was not doing what it said it was regarding ESG processes.

At the Standards Board for Alternative Investments (SBAI), we have a mission to improve industry outcomes. Disclosure and proper governance, including of ESG investment processes, are crucial to this mission. To support this, we have a Responsible Investment Working Group comprised of almost 200 global representatives of asset managers and institutional investors. This group has produced guidance on proper disclosures in a Responsible Investment Policy and this year will be working on how to practically evidence that these policies are being followed in the investment process and beyond.

Adam S. Aderton, Co-Chief of the SEC Enforcement Division’s Asset Management Unit and a member of the Climate and ESG Task Force commented

“As this action illustrates, the Commission will hold investment advisers accountable when they do not accurately describe their incorporation of ESG factors into their investment selection process.

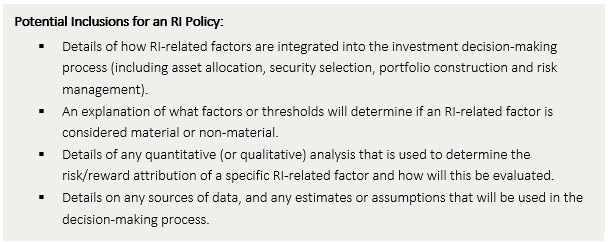

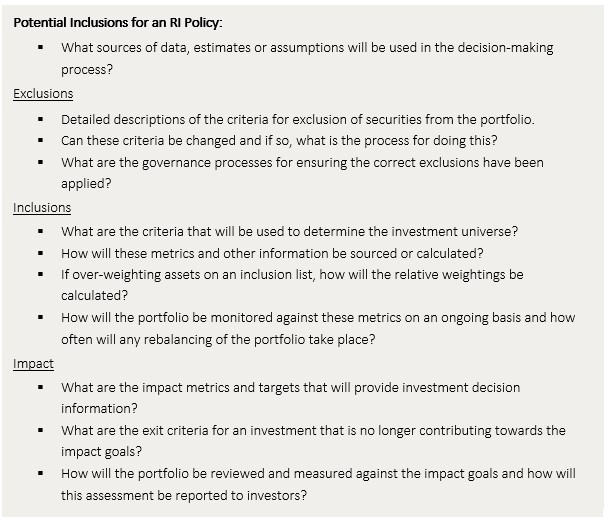

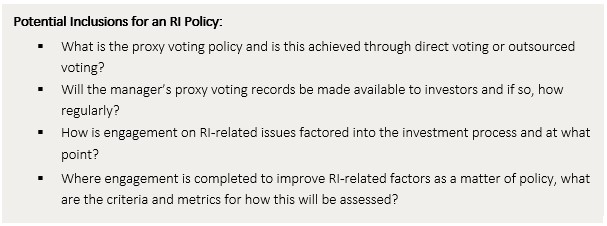

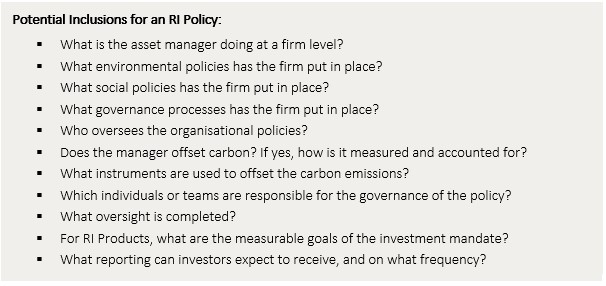

Below we highlight the thought process for developing a comprehensive policy and a selection of recommended disclosures from our Responsible Investment Policy Framework.

Understand your Approach to Responsible Investment

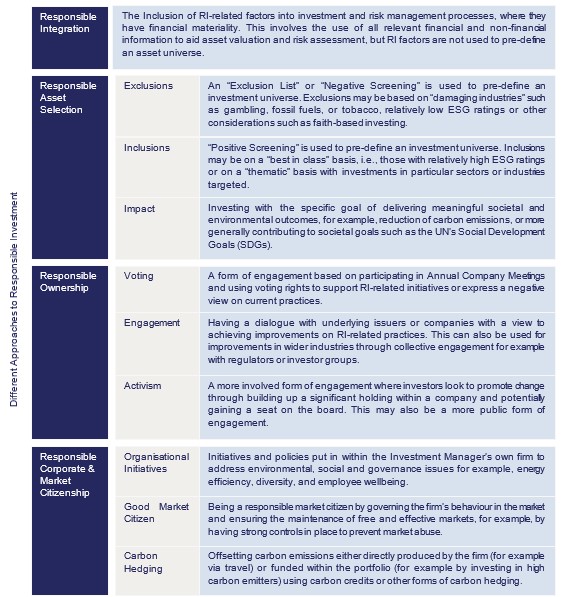

There is a spectrum of approaches to Responsible Investment (RI) and an adviser may offer different products that sit on different parts of this spectrum. An adviser’s approach may be determined by considerations, such as investor requests, its own philosophy, strategy and asset class considerations or regulatory requirements.

The spectrum of approaches includes:

Advisers should consider disclosing in their policy what the high-level RI objectives are, where products sit on the spectrum of approaches, whether the adviser intends to run any dedicated RI products and the level of resources that will be dedicated to RI processes.

Responsible Integration

We define this as the Inclusion of financially material RI-related factors into investment and risk management processes, but RI factors are not used to pre-define an asset universe. Elements of RI Integration have historically been present in traditional research processes where the factors have financially materiality. Approaches can be qualitative or quantitative and the materiality of E, S and G factors will vary for different asset classes and strategies.

Responsible Asset Selection (Exclusions, Inclusions and Impact)

We define this as a process where RI-related factors pre-define the investment universe for the product either by excluding certain assets, sectors or industries or through positive selection of assets based on RI-related criteria.

There are many practical considerations on the use of these approaches in different alternative investment strategies, asset classes and instrument types. We discuss many of these in our supplementary guidance memos taking a deep dive into Equity Long/Short, Macro, Systematic, Credit and Insurance Linked Strategies. These memos can be found in our Responsible Investment Toolbox.

Responsible Ownership (Voting, Engagement and Activism)

The types of engagement practices open to advisers will depend on the strategy, asset classes and instrument types traded. Again, we discuss the types of engagement available in different alternative investment strategies in our strategy specific guidance memos available in our Responsible Investment Toolbox.

Responsible Corporate Market Citizenship (Organisational Initiatives, Good Market Citizenship and Carbon Offsets)

This section covers the firm itself rather than the investment process but good disclosures in this area are equally important and of increasing interest to institutional investors.

Importance of Governance of the RI Investment Process

Accurate and detailed disclosures are vital for asset managers but as evidenced by this SEC enforcement action doing what you say you are doing is important. Going forward in our Responsible Investment Working Group, we will be discussing and producing guidance on how to practically demonstrate adherence to policies. This will not only be required by regulators but increasingly by institutional investors also.

Reach out to us for more information on our published guidance or Responsible Investment Working Group.