Financial Stability: Better Data from Banks to Assess Potential Systemic Risk

A series of events in recent years, including the Archegos family office failure, the collapse of Silicon Valley Bank, and the apparent growth of the basis trade in US Treasury markets, have renewed calls for greater insight into exposures between the bank and nonbank sectors. This was most recently highlighted by FSB Chair Klaas Knot, who highlighted the need for additional transparency:1

"In some areas we can mitigate the risk by having more transparency," Knot said, in an allusion to making banks share information on lending to hedge funds and other institutions.

We, at the SBAI, support the regulatory community in their efforts to understand and address any potential systemic risk. We have a long history of engaging on these matters, through IOSCO, as well as by responding directly to regulatory consultations2. In addition, the SBAI provides a wide range of transparency tools and Standards that help address these concerns3.

The SBAI’s approach has been multipronged. Our Standards and Guidance extensively cover risk management, valuation and disclosure at the level of individual fund managers, and we would like to highlight two particularly important components:

- Manager Disclosure to Prime Broker Counterparties: In 2008, the SBAI has endorsed the recommendation of the Counterparty Risk Management Policy Group II (CRMPG II) and adopted a Standard that ensures that managers provide pre-agreed information reports to counterparties in a timely manner, to enable adequate risk management by these counterparties.

- Open Protocol Risk Reporting: In 2017, the SBAI adopted the Open Protocol, which provides extensive risk information to investors, including detailed gross long and short exposures of investment managers, alongside counterparty risk and stress test results. Funds accounting for over USD 1.87tn in assets voluntarily provide Open Protocol Reports to their investors. The SBAI has encouraged financial regulators around the globe, including IOSCO, to adopt or recommend the Open Protocol, or, at least incorporate elements of this comprehensive reporting in their own risk reporting frameworks.

Separately, the SBAI also had developed a financial stability dashboard, which highlights the analyses regulators can undertake to assess any potential systemic concerns risk arising from hedge fund activity from their own regulatory data collection efforts. The dashboard was most recently included in our response to ESMA’s consultation on Leverage Risk in 20204 and has been presented to many financial authorities over the last 5 years.

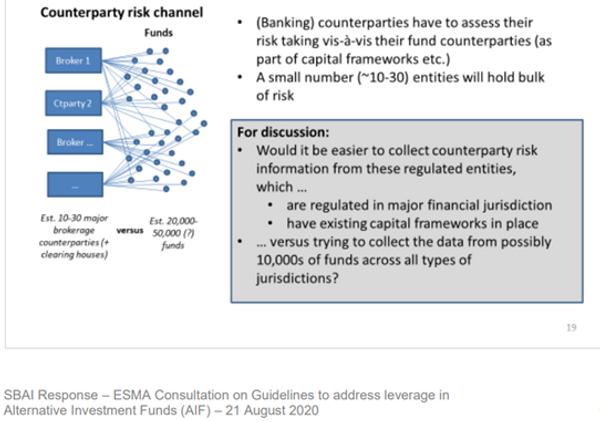

One particular recommendation we have made for many years is that rather than only focusing on collecting (and aggregating) data from thousands of investment managers spread across multiple jurisdictions around the globe through inconsistent national reporting templates, prudential (banking) regulators should undertake more targeted data collection efforts focusing on the much smaller universe of banking entities that actually interact with the non-bank financial institutions, such as hedge funds. Such an approach would be far less cumbersome, and also could provide additional insight into important aspects such as margining and risk management practices by such entities.

SBAI Systemic Risk Dashboard (excerpt): Understanding Counterparty Risk Transmission Channel

We welcome Mr. Knot’s suggestion to enhance data collection from banking entities regarding their exposure to non-bank financial institutions.

We, at the SBAI, stand ready to continue to engage constructively on matters in relation to financial stability with the authorities. We will continue to review market incidents, to understand what the alternative investment industry can learn from them, and how we can refine our Standards and disclosure frameworks to help address any potential systemic risk concerns. We would like to encourage financial regulators and industry stakeholders to review the SBAI’s resources on this.

Footnotes:

[2] SBAI engagement with authorities, including FSB, IOSCO, ESMA and European Commission since 2009

3 Alternative Investment Standards, Open Protocol Risk Reporting, Administrator Transparency Reports

4 SBAI Response to ESMA Consultation on levelage risks