FCA Dear CEO Letter and the Alternative Investment Standards

Investment strategies that carry inappropriate levels of risk for their target client

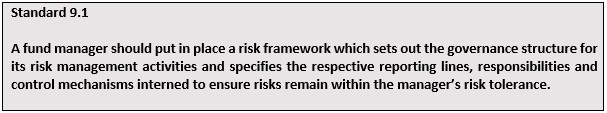

The FCA notes it has seen examples of informal governance processes compounded by poor due diligence and inadequate investor categorisation, leading to investors with lower risk appetite accessing high risk products that may not match their objectives. At the SBAI, risk management one of the key focus areas of the Alternative Investment Standards.

A manager’s risk tolerance for individual products should in part be determined by the level of risk appropriate for its target investor base. Asset manager signatories to the SBAI Alternative Investment Standards commit to have this framework in place and, importantly, to having a formal governance structure in place for risk management.

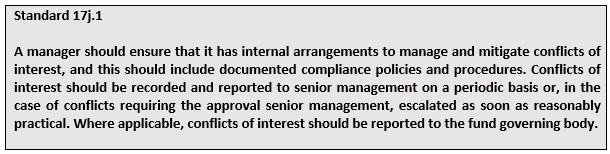

Conflicts of Interest

This topic continues to feature highly on regulatory priorities and the FCA is asking firm boards or executives to review these procedures to ensure conflicts and be properly avoided, managed or disclosed.

There are many areas where conflicts of interest can occur for alternative asset managers, including valuation, risk management, compliance and running parallel funds among others. Asset manager signatories commit to having proper processes in place to address conflicts of interest in at least nine of the Alternative Investment Standards, demonstrating the many opportunities for these conflicts to arise; however, the following standard clearly articulates what the FCA is asking for

There are some areas where identifying and managing conflicts of interest can be more complicated; here at the SBAI we have produced some practical guidance to managing these conflicts:

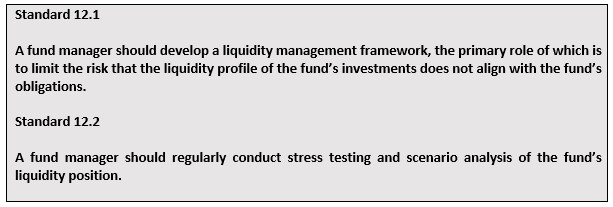

Market integrity and disruption

The FCA comments that robust risk and liquidity management is essential at any time, but especially so given increased market volatility and rising interest rates which is leading to several new coexistent risks for alternatives managers.

As discussed before, risk and liquidity management are a core part of the SBAI Alternative Investment Standards and our asset manager signatories commit to, along with other standards:

We discuss more on the role the Alternative Investment Standards can play in effective liquidity risk management in an earlier thought piece on Liquidity Risk Management.

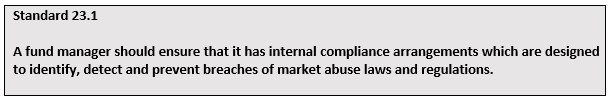

Market Abuse

The FCA observes that market abuse controls across the sector need to be improved and where firms do not comply with existing rules, it will consider the need for criminal, civil or supervisory sanctions to provide effective deterrents.

As with all Alternative Investment Standards guidance is provided on how asset manager signatories can achieve compliance with each Standard. The guidance for this standard contains a detailed table providing examples of compliance procedures designed to identify, detect and prevent market abuse in areas such as insider dealing, dissemination of inside information, position disclosures and prevention of market manipulation.

Culture

While the FCA discusses the importance of remuneration and of staff being able to speak up freely, it also highlights that firms should consider the steps they can take to provide an environment where diverse talent can flourish, and diversity of thought is encouraged. It also notes that the consultation following its discussion paper on diversity is expected later in 2022.

This is an important topic for us at the SBAI and our Culture and Diversity Toolbox contains practical guidance for firms in areas such as creating inclusive cultures. You can also read our response to the FCA’s Discussion Paper on Diversity here.

ESG

This topic gains more and more prominence in regulatory priorities each year. The FCA highlights the need to ensure that documentation of ESG focused products is clear, not misleading and that firm’s actions match the stated claims.

Our Responsible Investment Toolbox contains a wealth of practical guidance to ensure proper documentation of ESG processes. This includes a Responsible Investment Policy Framework that walks through determining, documenting and governing your approach and, strategy specific supplementary memos covering equity long/short, credit, macro, systematic and insurance linked strategies.